How to Submit a Compelling Application for the Incfile Fresh Start Business Grant in 2024

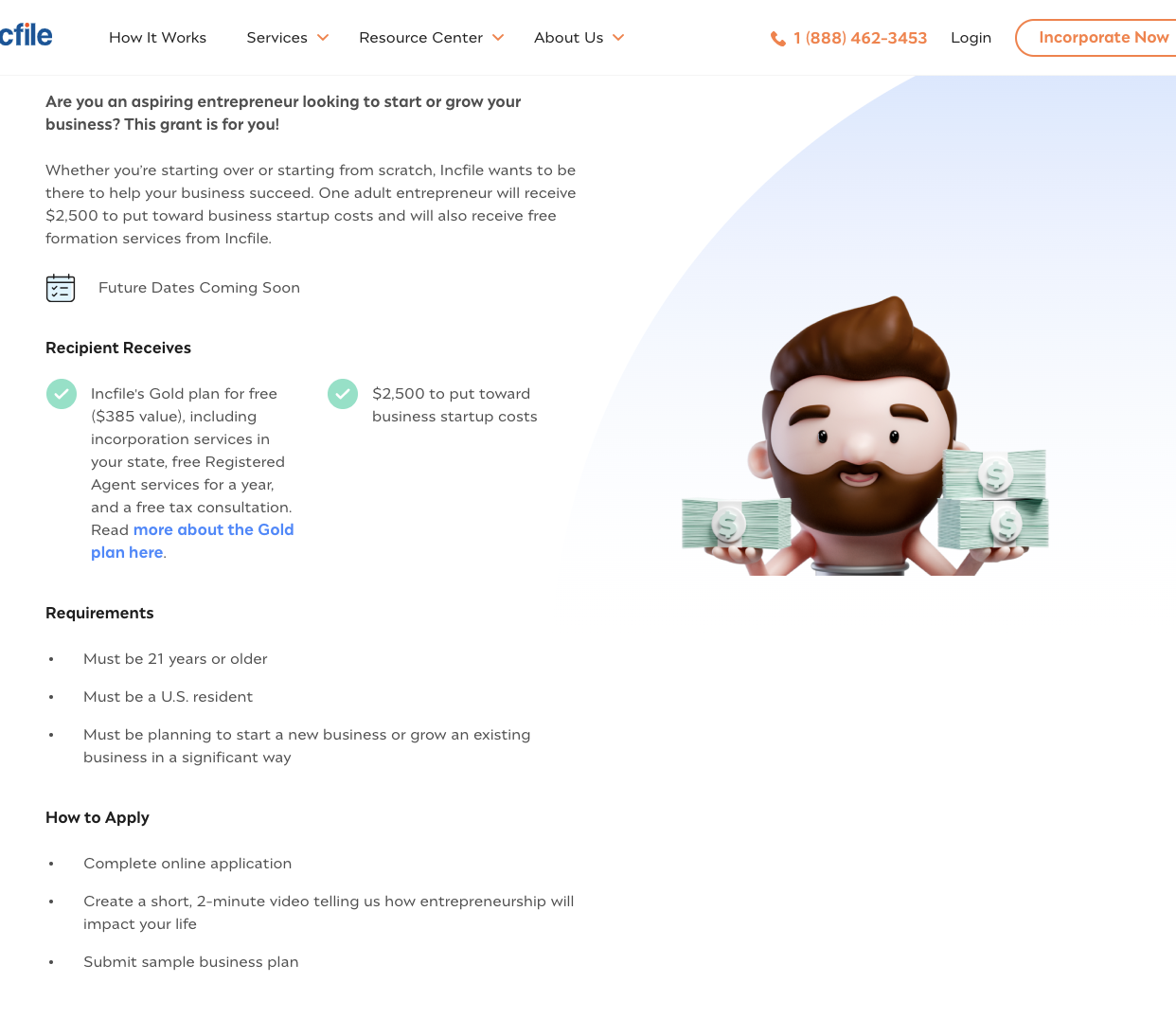

To successfully apply for the Incfile Fresh Start Business Grant, it is important to understand the grant application process and how to create a compelling application. The grant provides $2,500 toward startup costs and additional services to help entrepreneurs start or restart their businesses. Following these steps can increase your chances of securing the grant and achieving your entrepreneurial goals.

Eligibility Criteria for the Incfile Fresh Start Business Grant

You must meet certain eligibility criteria to be considered for the Incfile Fresh Start Business Grant. These criteria have been put in place to ensure that the grant is awarded to individuals committed to entrepreneurship and with a clear vision for their business. Here are the key requirements:

Must be a U.S. Resident

In order to qualify for the Fresh Start Business Grant, you must be a resident of the United States.

This grant is specifically designed to support entrepreneurs within the country and contribute to the growth of the local economy.

Minimum Age Requirement:

You must be at least 20 years old to be eligible for the grant. This age requirement ensures that applicants have a certain level of maturity and experience to manage and develop their business ideas effectively.

New or Significant Business Growth:

The grant is intended for individuals planning to start a new business or significantly grow an existing one. Whether you have a groundbreaking startup idea or a solid plan to scale your current business, the Fresh Start Business Grant can provide the financial assistance you need to make it happen.

| Eligibility Criteria | Description |

|---|---|

| U.S. Resident | Must be a resident of the United States. |

| Minimum Age | Must be at least 20 years old. |

| New or Significant Business Growth | Planning to start a new business or grow an existing one. |

Meeting these eligibility criteria is the first step towards securing the Incfile Fresh Start Business Grant. Suppose you meet these requirements and have a compelling business idea. In that case, you are on your way to receiving the financial assistance and resources you need to turn your entrepreneurial dreams into reality.

Required Documentation and Materials

When applying for the Fresh Start Business Grant, gathering all the necessary documentation and materials to support your application is essential. Providing the required paperwork and evidence demonstrates your preparedness and commitment to starting or growing your business.

Required Documentation and Materials

| Document/ Material | Description |

|---|---|

| Proof of Business Incorporation | A legal document such as Articles of Incorporation or Certificate of Organization establishes your business as a legal entity. |

| Employer Identification Number (EIN) | An EIN is obtained from the Internal Revenue Service (IRS) and is necessary for tax purposes and hiring employees. |

| Business Bank Account | A dedicated bank account for your business to manage finances separately from personal funds. |

| Detailed Business Plan | A comprehensive plan outlining your business goals, strategies, target market, and financial projections. |

| 2-Minute Video | A short video highlights entrepreneurship’s impact on your life and the potential of your business. |

| Supporting Documents | Any additional materials the grant application requires, such as financial statements, licenses, or permits. |

Having all these documents and materials ready, you can present a strong case for receiving the Fresh Start Business Grant. Ensure that all documentation is accurate, up-to-date, and reflects the vision and potential of your business.

The Application Process: How to Apply for the Fresh Start Business Grant

Applying for the Fresh Start Business Grant is straightforward and requires attention to detail and careful preparation. To begin, visit the official Incfile website and navigate to the grant application page. Fill out the online application form (which was unavailable at the time of writing this piece), providing accurate and comprehensive information about your business, including your business plan, financial projections, and the impact of entrepreneurship on your life. Be sure to double-check all the details before applying.

In addition to the application form, you will need to create and submit a 2-minute video explaining the impact of entrepreneurship. This video is an opportunity for you to showcase your passion, determination, and vision for your business. Make sure to articulate how the grant funding will help you achieve your goals and contribute to the growth of your business.

The deadline to apply was June 30, 2023. So, bookmark this page, and we will be sure to update you through this article once the grant becomes available again. It is essential to plan your time accordingly and avoid any last-minute rush.

Take the time to gather all the required documentation and materials, such as your business incorporation documents, Employer Identification Number (EIN), and any additional supporting documents that may be required. By submitting a complete and compelling application, you increase your chances of being considered for the Fresh Start Business Grant and receiving the financial support you need to kick-start your entrepreneurial journey.

| Application Process Checklist |

|---|

| Create a compelling business plan |

| Complete the online application form accurately |

| Submit a 2-minute video explaining the impact of entrepreneurship |

| Prepare all required documentation and materials |

| Submit the application before the deadline (June 30,2023) |

Following these steps and meeting all the requirements, you can successfully navigate the grant application process and increase your chances of securing the Fresh Start Business Grant. Remember, this grant offers valuable financial assistance and resources to help you start or restart your business, so it’s worth putting in the effort to create a compelling application that highlights your potential as an entrepreneur.

What the Fresh Start Business Grant Includes

The Incfile Fresh Start Business Grant provides several benefits to the recipient. The grant includes $2,500 to be used toward startup costs, incorporation services in the applicant’s state, one year of registered agent service, an Employer Identification Number (EIN), and annual reporting for the first year. The grant includes Incfile’s tax accounting bundle and assistance in setting up a Google My Business profile if applicable. These resources and services aim to provide financial assistance and support to entrepreneurs as they launch or restart their businesses.

Overview of Fresh Start Business Grant Benefits

| Benefit | Description |

|---|---|

| Startup Costs Funding | $2,500 to be used towards business startup expenses |

| Incorporation Services | Assistance in incorporating the business as a legal entity |

| Registered Agent Service | One year of registered agent service for legal compliance |

| Employer Identification Number (EIN) | Assistance in obtaining an EIN for the business |

| Annual Reporting | Guidance and support for the first year’s annual reporting |

| Tax Accounting Bundle | Access to Incfile’s tax accounting resources |

| Google My Business Setup | Help in establishing a Google My Business profile |

These benefits are designed to provide entrepreneurs with the essential resources and services they need to start or restart their businesses. By receiving financial assistance, incorporation support, and ongoing guidance, entrepreneurs can focus on bringing their business ideas to life and driving success in their ventures.

The Fresh Start Business Grant is a valuable opportunity for entrepreneurs seeking financial assistance and support. With its wide range of benefits, the grant can help entrepreneurs overcome some of the initial challenges of starting or restarting a business. By leveraging the resources offered by the grant, entrepreneurs can position themselves for long-term success and make their business dreams a reality.

Finding Grant Funding Opportunities for Small Businesses

When it comes to funding your small business, grants can be a valuable resource. These financial assistance programs are available from various sources, including government agencies, private corporations, organizations, and foundations. In fact, the government is a significant provider of business grants at the local, state, and federal levels, distributing billions of dollars in grant funding each year. To tap into these opportunities, conducting thorough research and identifying the grants that align with your business needs is essential.

One way to find government grants for startups and small businesses is by consulting local resources. Small Business Administration (SBA) chapters, Small Business Development Centers (SBDC), and local economic authorities can provide valuable information and guidance on available grants. These organizations deeply understand the local business landscape and can help you navigate the grant application process.

Additionally, online databases and grant directories are excellent tools for finding business funding opportunities. Websites such as grants.gov, foundationcenter.org, and sbir.gov provide comprehensive lists of available grants, eligibility criteria, and application details. These resources allow you to filter grants based on your industry, location, and business objectives, making finding the right funding opportunity for your small business easier.

Government Grants for Small Business: Key Points

- Grants for small businesses are available from government agencies, private corporations, organizations, and foundations.

- Local resources such as SBA chapters, SBDCs, and local economic authorities can provide information on available grants.

- Online databases and grant directories offer a comprehensive list of grants and allow you to filter based on industry and location.

| Government | Amount | Eligibility | Application Deadline |

|---|---|---|---|

| Federal Government | $721 billion | Varies by grant | Depends on the grant |

| State Government | Varies by state | Varies by grant | Depends on the grant |

| Local Government | Varies by locality | Varies by grant | Depends on the grant |

As a small business owner, exploring all possible funding avenues is crucial, and grants are a compelling option to consider. By leveraging the resources and opportunities available, you can give your business the financial boost it needs to thrive and succeed.

Conclusion

The Incfile Fresh Start Business Grant offers a valuable opportunity for entrepreneurs like you to secure business funding and receive support for your ventures. By understanding the grant application process, eligibility criteria, and required documentation, you can create a compelling application that stands out from the competition. Taking advantage of funding opportunities, such as grants for small businesses, is essential in turning your entrepreneurial dreams into reality.

With the Incfile Fresh Start Business Grant, you have the chance to receive financial assistance and resources to start or restart your business. The grant provides $2,500 in funding that can be used for startup costs, along with incorporation services, registered agent service, an Employer Identification Number (EIN), and annual reporting for the first year. Additionally, Incfile offers their tax accounting bundle and assistance in setting up a Google My Business profile if applicable.

By capitalizing on business funding opportunities like the Incfile Fresh Start Business Grant, you can gain the financial support and resources needed to turn your entrepreneurial vision into a thriving reality. Don’t miss out on this chance to receive the assistance you need to launch or restart your business successfully. Apply now and take the first step toward achieving your entrepreneurial goals!